The end of this year financially got on top of me, and its time for me to face the music and get back on track.

If you know anything about me, it is that I am a Recovering Super Spender who does NOT use credit cards for daily spending. I lose track of transactions almost immediately, and underestimate how much I’ve spent at all times. However, one of my passion projects includes putting designs on Glass Can Tumblers. While I do have an amount of cash reserved for materials, I ended up needing to purchase more supplies before I was ready and decided using a credit card would be best in this situation. To add to the confusion, I misplaced my main debit card and lazily defaulted to a credit card for daily spending until it was replaced. The credit card short cut always bites me… so here’s how I get back on my feet.

Step 1: Know What You Have… and what you don’t.

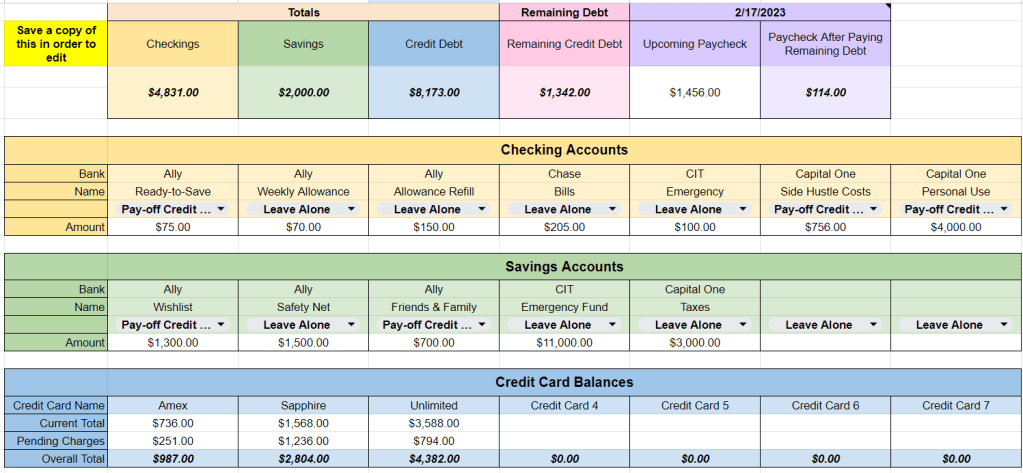

I start by getting visibility on my immediate situation. Specifically, what my high interest debt is and what I can use to pay it off. I’ve done this so many times over the years I have a google sheets template for it. I call it my Credit Debt Payoff Calc template; truly just a pretty shortcut to face the credit debt situation.

While this template gives me visibility on all the money I have access to, I don’t necessarily want to use all of it to payoff the credit card debt. I specifically want to leave myself with enough cash to cover my living expenses… otherwise I end up in a credit debt loop that seemingly has no end. So, using the information you have, decide how you will payoff your credit card balance. How many paychecks will it take? Can we cut any expenses until its paid down? Can we return anything we purchased? How are we going to dig ourselves out of this hole? If I don’t have enough in my preferred accounts to payoff the debt, I have no issue dipping into the emergency fund money. As far as I’m concerned, if I have credit card debt the money doesn’t count as savings anyways. Luckily, for my situation right now, my additional income was able to fully cover the debt I accumulated in a mere 3 weeks, and I am back to debit card only!

Step 2: Execute the Plan

The next thing we want to do is move the money to where it should be. Payoff the credit cards from the accounts you decided on, and set up automatic payments if you need to.

If you’re not confident you’ll be able to refrain from using credit cards, now is the time to remove them from your wallet and unsave them from your digital wallets.

Step 3: Look to the Future

I bought nearly everything on my Wishlist, and I have taken the 2023 trips I was going to take. So what now? What do I want to save for in 2024?

My top priority is building my Emergency Fund. I currently have $10k to fall back on, and while this is usually my sweet spot, I want would feel more comfortable if I could actually double it.

Going on vacation with my husband and friends is something I thoroughly enjoy. From planning to going, I am ecstatic the entire time. Having even one group trip to look forward to can make my entire year. That being said, I would like to save $5k-$7k for travel in 2024.

Something less enjoyable, but absolutely necessary to save for is Immigration fees. Whether its for the US or UK we are going to need to payout several thousand dollars to file paperwork. My savings goal for this is $6k.

The last thing I’m going to name is actually a Wishlist item. I would like to buy a camera. It doesn’t need to be the best, just good enough. My savings goal for this is $400.

My Savings Goals for 2024:

Emergency Fund – $20,000

Vacations – $7,000

Immigration Fees – $6,000

Wishlist – $400

Step 4: Gameplan

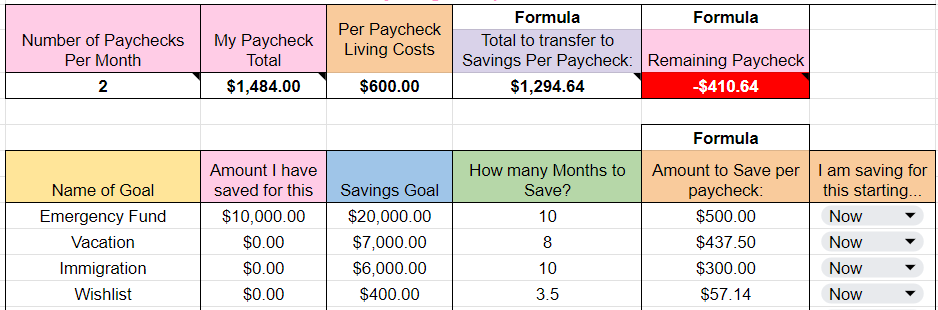

The last thing we need to do is figure out how much we need to save per paycheck or per month to achieve our financial goals. Of course, I have a template for this, but doing it by hand is just as easy.

If I want to reach all of my savings goals within 2024 I will need to set aside $1,294.64 per paycheck. It looks like $410 of that amount will need to come from other places (aka side hustles). If I want all of my savings goals to come from my career paycheck, I would need to figure out a realistic time frame and goal by editing the amount of months I’d like to save these balances in, or maybe lower my expectations. As it stands I feel like these work for me.

Final Thoughts

Its difficult for me pull myself out of Holiday Shopping mode since I enjoy it so much, but it is something I want and need to do. I feel better knowing the reality of my situation and how I’m going to move forward in it. I am heading into 2024 with reasonable optimism and a savings plan!

Rebecca Sowden

Leave a comment